Budget 2025: Key Highlights

Focus: Economic resilience, inclusive growth (poor, youth, farmers, women), MSMEs, startups.

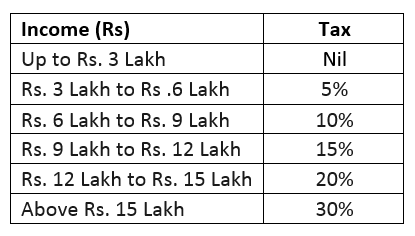

Taxation: No tax up to ₹12 lakh (new regime), relief for higher incomes, simplified slabs/TDS/TCS, higher LRS threshold (₹10 lakh), increased rent TDS threshold (₹6 lakh), no TCS on education loans (up to ₹10 lakh). New tax bill.

Fiscal: FY25 deficit 4.8% GDP, FY26 target 4.4%. ₹28.37 lakh crore tax receipts (FY26 est.), ₹14.82 lakh crore borrowing. ₹10.18 lakh crore capex (FY25 rev.), ₹1.5 lakh crore interest-free loans to states.

Agriculture: Program for low-productivity districts, high-yielding seeds mission, creating sustainable fisheries. Infra: Broadband for schools/healthcare, expanded Udaan, ₹25,000 crore maritime fund, airport/canal projects.

Industry: National Manufacturing Mission, new urea plant, solar/battery ecosystem, footwear/toy schemes, India Post logistics.

Education/Skills: 5 skilling centers, IIT boost, AI centers (₹500 crore), 50,000 tinkering labs.

New Income Tax Slabs 2023 - 24

Major Highlights

- Railways get highest ever allocation of Rs 2.4 Lakh Crore

- Agricultural credit target increased to Rs 20 Lakh Crore

- 50 additional Airports, Heliports planned

- Mahila Samman Savings Certificate for two years, deposits of up to Rs 2 Lakh at 7.5% Interest

- Senior Citizen’s Savings Scheme deposit limit raised to Rs 30 Lakh

- Income tax rebate limit increased from Rs 5 Lakh to Rs 7 Lakh under new tax regime

- Allocation for PM Awas Yojna increased by 66 % to over Rs 79,000 Crore

- 157 New Nursing Colleges in Major Locations

- Eklavya Model Residential Schools - 38,800 Teachers will be hired

- 3 centers for excellence for AI will be set up in Top Educational Institutes

- Green Hydrogen Mission for reduced dependence on fossil fuel

- 30 Skill India international centers to be set up

- Natural Farming - 1 Crore farmers will get assistance